While currency in circulation improved, ATMs still run dry

The survey stated, RBI's move in lifting up withdrawal limit on March 13, 2017, could have attributed to the happenings.

To come back at pre-demonetisation level, the printing presses have been working overtime to replenish the currency into banking system.

Data compiled by the Reserve Bank of India stated that, there has been 42% increase in currency-in-circulation (CIC) from January 2017 – March 2017 period.

Interestingly, although CIC has improved in last three months, cash availability into ATMs has still not seen any revival.

TRENDING NOW

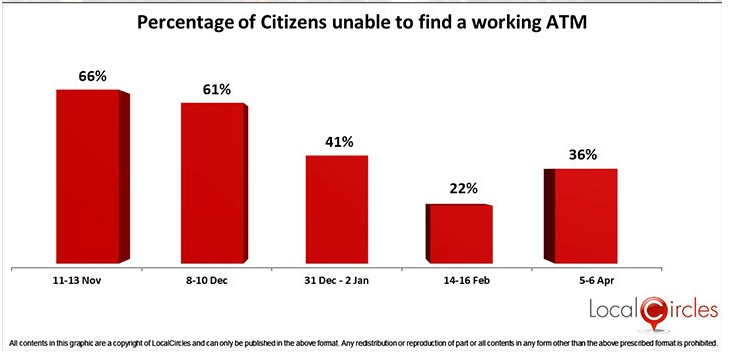

As per LocalCircle's survey, about 36% Indian still could not find a cash dispensing ATM between April 04 – April 08, 2017.

This number has increased from 22% who had faced problems in finding a cash dispensing ATM a month back between February 14 – February 16.

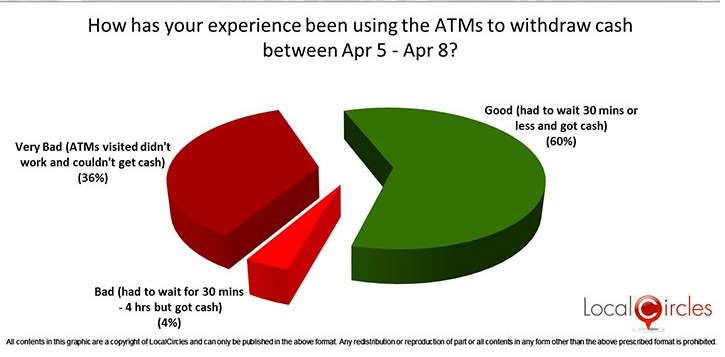

Whereas, about 60% said after waiting for 30 minutes they have managed to remove cash in first week of April 2017, while 4% said they had to wait between 30 minutes – four hours to get cash in the same week.

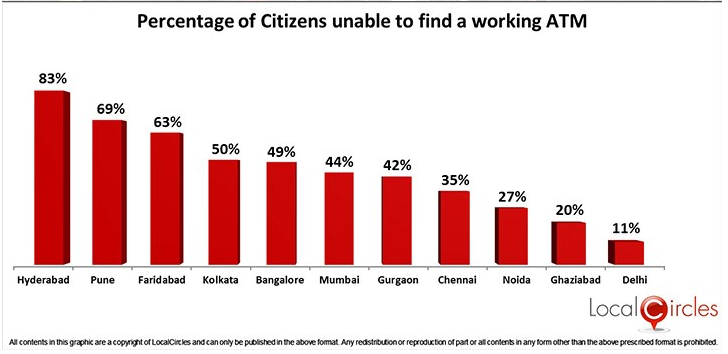

Among 11 cities across India, Hyderabad was worst hit with ATM outages at 83%, followed by Pune at 69%, Faridabad at 63%, Kolkata at 50%, Banglore at 49%, Mumbai at 44% and Gurgaon at 42%.

The survey stated, RBI's move in lifting up withdrawal limit on March 13, 2017, could have attributed to the happenings.

It added, “People have been withdrawing cash in bulk from the counters and the banks have been forced to maintain high liquidity. This has resulted in the maintainance of ATMs taking a back seat and them not getting replenished with cash frequently."

Also, Indians have been withdrawing a large amounts from ATMs because of some banks levying a transaction fee after 4 withdrawal from ATMs which has resulted in ATMs going out of cash.

On March 02, 2017, HDFC Bank, ICICI Bank, Axis Bank and State Bank of India levied transaction charges after a certain withdrawal limit.

Earlier, LocalCircles carried a survey under which it was known 70% people were against the move of new charges on cash transaction.

CIC by end of March 2017, stood over Rs 13.35 lakh crore less by Rs 4.62 lakh crore from total currency of Rs 17.97 lakh crore which stood at pre-demonetisation level.

While CIC was at Rs 10.16 lakh crore in January 2017 and Rs 11.64 lakh crore in February 2017. From November 08, 2016 (start of demonetisation period), CIC declined to Rs 9.87 lakh crore in December 2016.

PM Narendra Modi's demonetisation drive which was announced to curb black money ended on December 31, 2016.

03:26 pm

2,000-rupee note: A barrage of memes on social media as RBI presses 'exit' on 2,000 currency bill

2,000-rupee note: A barrage of memes on social media as RBI presses 'exit' on 2,000 currency bill Bye bye, Rs 2,000 banknote! 10 things to know about the bill that has been in circulation for 6 years

Bye bye, Rs 2,000 banknote! 10 things to know about the bill that has been in circulation for 6 years Finance Minister Nirmala Sitharaman says govt hasn't stopped banks from filling Rs 2000 notes in ATMs

Finance Minister Nirmala Sitharaman says govt hasn't stopped banks from filling Rs 2000 notes in ATMs Demonetisation in India: Timeline

Demonetisation in India: Timeline Demonetisation SC Verdict Today: Supreme Court to pass judgement on pleas challenging Centre's 2016 note ban

Demonetisation SC Verdict Today: Supreme Court to pass judgement on pleas challenging Centre's 2016 note ban