A final check: How GST impacts your toothpaste to your car purchase

With the GST rollout at the stroke of midnight tonight here is how it will impact your business, industry and even your household finances.

With barely a few hours left for the goods and service tax (GST) to be rolled out, many are still trying to understand how GST will impact their business, service and even household finances. On the stroke of mid-night (12am) today the government will launch its biggest economic plan the GST. Purely from a taxation perspective, GST is likely to be neutral.

Most companies are busy with the implementation of this herculean task, but a major challenge is going to be the cost of compliance across the value chain, says analyst Naveen Kulkarni from Phillip Capital India Research. He further adds that the higher cost of compliance and sustenance of higher taxes will continue to be a deterrent for higher participation in the formal system.

Kulkarni says that GST will throw the system into chaos over the next three months, as the channel adapts. “Large companies have better‐prepared IT systems, which could translate into market‐share gains. Primary sales in the B2C segments will be sluggish in the transition period, but we expect a pick up from the festival season in Q3,” he said.

TRENDING NOW

Here is a list of how each sectors will be impacted and how much more or less your purchases will be due to the implementation of GST:

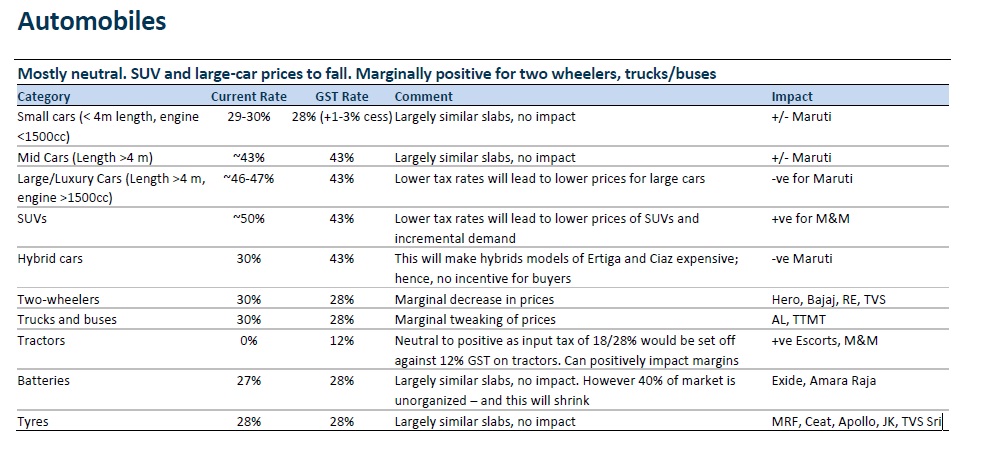

Automobiles:

The automobile sector will largely see a neutral impact due to GST. SUVs and large-car prices will fall. Luxury car prices will fall due to lower taxes under GST. The implementation of GST is marginally positive for two-wheelers, trucks and buses.

Source: Phillip Capital

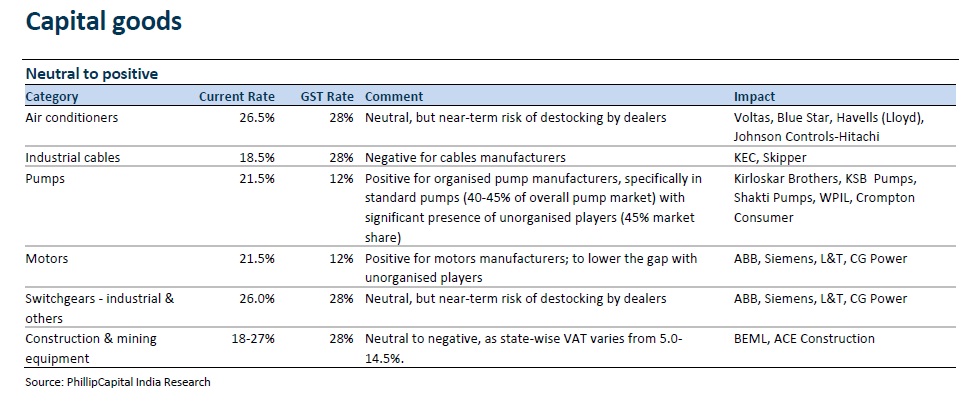

Capital Goods:

The capital goods sector will see a neutral to positive impact due to the GST roll-out. For air-conditioners it is neutral, industry cables will have a negative impact, pumps and motors will have a positive impact, and switchgears and construction and mining equipment will have a neutral impact due to implementation of GST.

Source: Phillip Capital

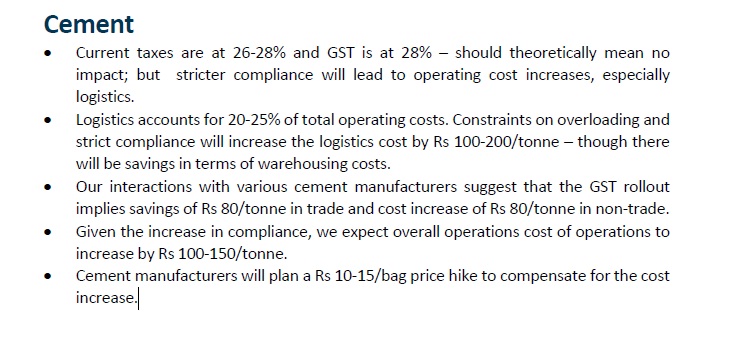

Cement:

The cement sector will largely see no impact due to GST, but stricter compliance will lead to operating cost increases, especially in logistics.

Source: Phillip Capital

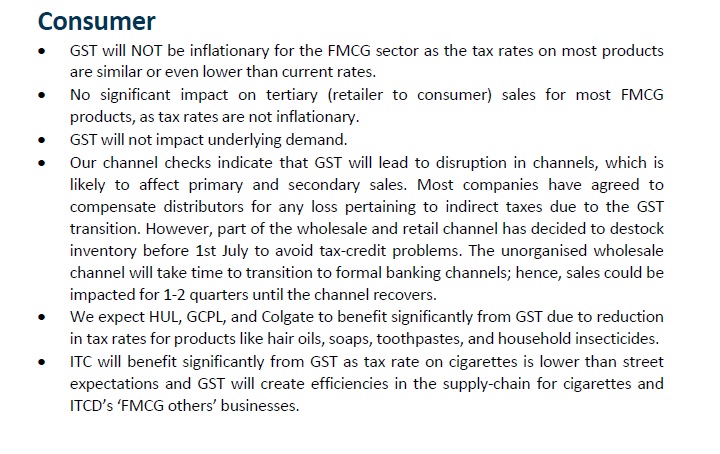

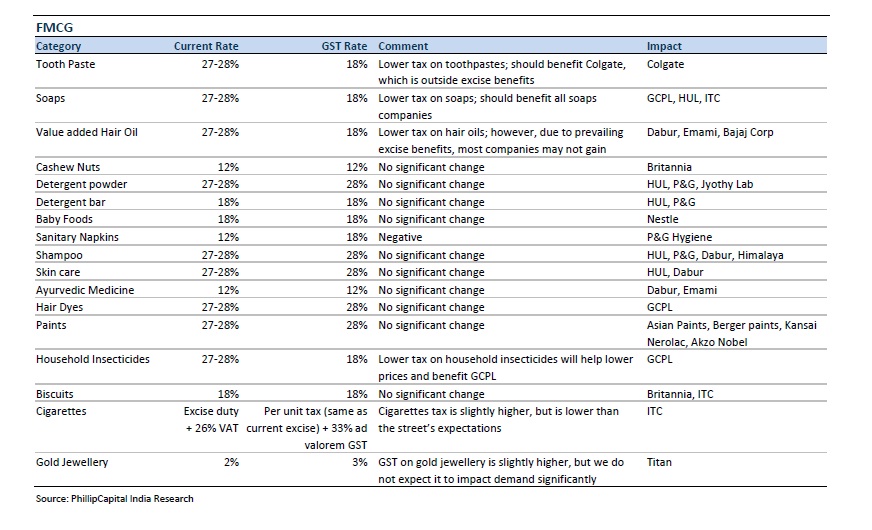

Consumer or FMCG:

GST will not be inflationary for the FMCG sector as the tax rates on most products are similar or even lower than current rates.

Source: Phillip Capital

Source: Phillip Capital

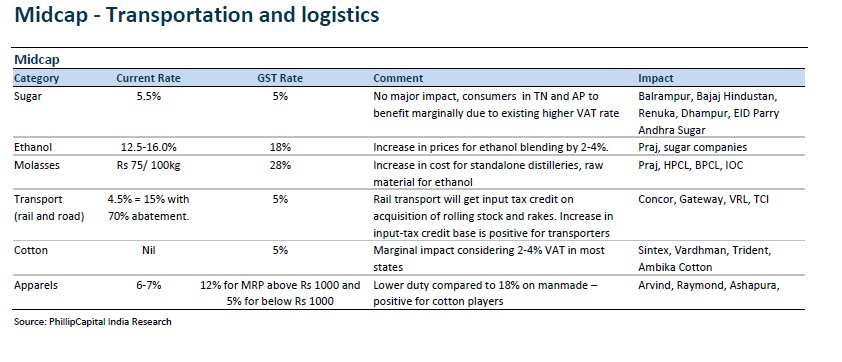

Transportation and logistics:

While GST will increase the prices of ethanol blending and molasses. In terms of transport, the rail transport will get input tax credit which is positive for transporters.

Source: Phillip Capital

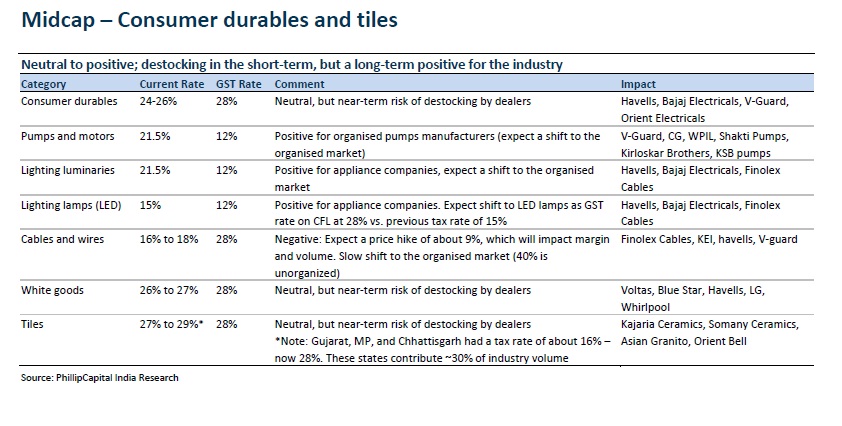

Consumer durables:

The Consumer Durables is expected to have a neutral to positive impact due to GST.

Source: Phillip Capital

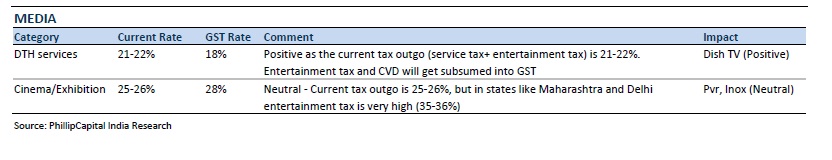

Media:

There is a positive to neutral impact on the media industry due to the implementation of GST.

Source: Phillip Capital

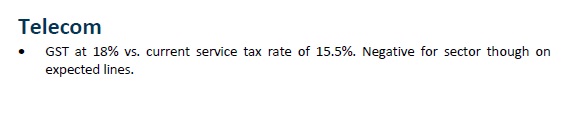

Telecom:

GST will have a negative impact for the telecom sector, which was expected. This is as GST for telecom has increased to 18% from the current service tax rate of 15.5%.

Source: Phillip Capital

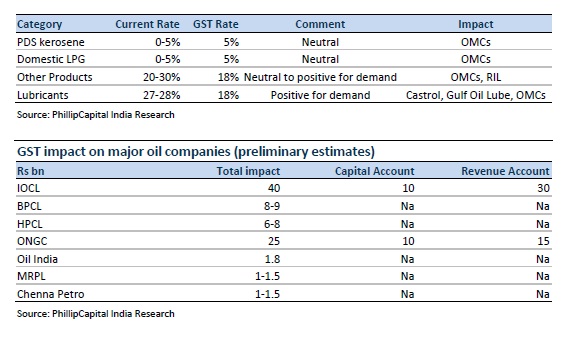

Oil and Gas:

The overall impact on the oil and gas industry is negative as the sector's participants cannot avail input tax credit for these products due to the regime mismatch. IGL has stated that a 45‐50paise/kg hike in CNG price.

Source: Phillip Capital

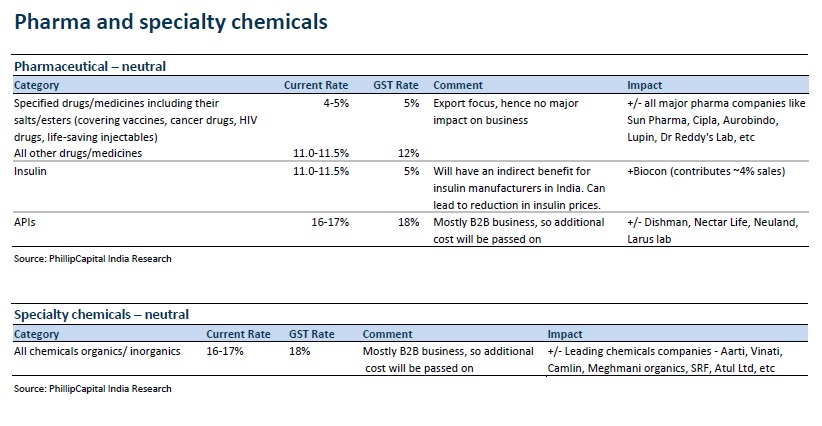

Pharma and specialty chemicals:

Specified drugs or medicines will not see a major impact due to GST as the rates are a little higher. Insulin prices will come down due to lower taxes under GST. APIs will increase a little and so prices will rise.

07:48 pm

GST: The transition issues and what it means for India

GST: The transition issues and what it means for India  SBI is ready for GST, Arundhati Bhattacharya says

SBI is ready for GST, Arundhati Bhattacharya says Sooner or later states will have to bring petroleum under GST, says Arun Jaitley

Sooner or later states will have to bring petroleum under GST, says Arun Jaitley