Indian economy on watch-list of S&P; positive rating can be reality in 2018

Two major agencies namely Moody's Investor Services and S&P have provided two different ratings outlook for India, one being cautious and other stating positive outlook for the country.

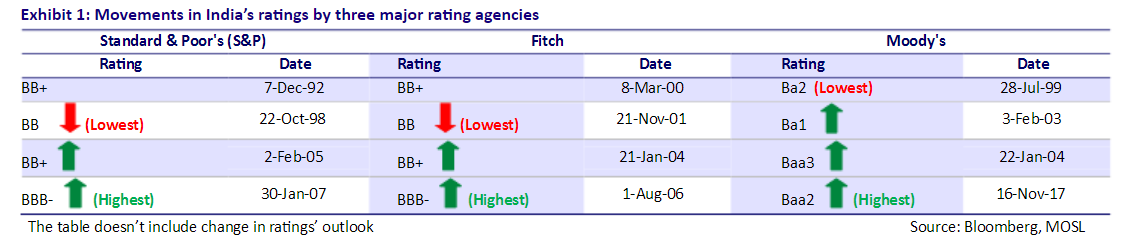

When Moody's Investor Services upgraded India's rating to “Baa2”, every economists and analysts welcomed the move as positive, and projected that other two rating agencies will also follow the suit.

Nikhil Gupta and Rahul Agrawal Research Analysts at Motilal Oswal after Moody's rating said, "However, since other rating agencies have not taken any rating actionfor more than a decade, we believe the time is ripe for them to revisit India’ssovereign ratings.This makes us believe that the other two agenciescould soon follow suit with a rating upgrade."

TRENDING NOW

After Moody's, all eyes were turned towards other two major agencies namely Standard & Poor's (S&P) and Fitch Group with excitement for an upgrade.

Surprisingly, S&P did not follow Moody's recent decision, and maintained India's sovereign rating unchanged at “BBB-minus” and stable outlook on November 24, 2017.

The S&P's statement said it was comfortable with its current rating, which leaves India at its lowest investment-grade standing, despite welcoming recent actions such as the unveiling of an ambitious national goods and services tax (GST), India`s biggest-ever tax reform.

Economic Affairs Secretary Subhash Chandra Garg talking to reporters, stated that the government is not disappointed with the S&P's decision to keep India's rating unchanged, as the agency has opted “to play a little cautious.”

S&P said, “Sizable fiscal deficits, a high net general government debt burden, and low per capita income detract from the sovereign`s credit profile."

Analysts also believe that near-term concerns still continue to haunt India's growth.

Suvodeep Rakshit, Upasna Bhardwaj and Madhavi Arora, analysts at Kotak Institutional Equities, maintained a negative bias in the short run due to risks emanating from fiscal slippage, upward trending inflation trajectory, higher crude oil prices, end of rate cut cycle and tightening of domestic liquidity.

The trio of Kotak for fiscal target said, “We expect the government’s fiscal deficit in FY2018 at 3.5% as against the budgeted 3.2% given the downside risks on receipts specifically from lower RBI dividend, excise duty cut on petroleum products, and GST collections.”

Recent International Monetary Fund (IMF) data revealed that India only inched up one position to 126th in terms of GDP per capital of countries – which is still ranked lower compared to all its BRICS peers.

India has seen its per capita GDP rise to $7,170 in 2017, from $6,690 last year, helping improve its rank by a position to 126th.

While India's GDP growth stands at three-year low at 5.7% in Q1FY18 compared to 6.1% in Q4FY17 and 7.9% in the corresponding period of the previous year.

India's economy is expected to be below 6% even in second quarter of FY18, owing to muted agriculture growth and sluggish performance of manufacturing and mining sector.

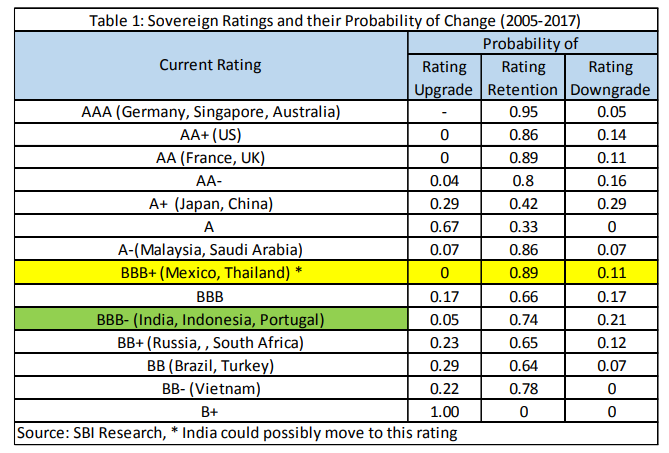

Also, State Bank of India (SBI) analysis of the foreign currency long term sovereign ratings given by S&P for a group of twenty countries for the period 2005-17, indicated that India has only 5% probability of rating upgrade. Thus a rating action was difficult.

Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser at SBI said, “Even if we assume that India is fortunate enough to find itself in 5%, it moves up to BBB. In BBB, however there is a 17% probability of moving to the BBB+ class. In BBB+, the chance of rating upgrade is minimal.”

Ghosh added, “Hence, India can at best hope to move into the BBB+ category, over the medium term. But once it crosses, A- there is a real chance of India getting into A+. This could be the long term story though!”

Thus, S&P made it clear, on waiting to see more evidence that government reforms would "markedly improve" the government`s finances and reduce its net general government debt to justify an upgrade.

As per Ghosh, given the fact that the Government is on the path of fiscal consolidation and serious about resolution of the bank asset quality problem through the Insolvency Code, a positive rating action seems most likely in 2018.

She added, "This is because, resolutions will possibly start to happen in Q4FY18, given the 6 month deadline and also that banks will get recapitalised by then at least through the first installment."

Moreover, everybody would be keenly watching for Fitch Group's rating outlook for Indian economy, but for now analyst do not expect any further upgrade from Moody's.

Motilal stated since neither a sharp decline in general government debt nor a strong revival in investments is on the anvil, another upgrade not in near term from Moody's.

03:12 pm

India could be $5 trillion economy by 2025, says Union Petroleum Minister Hardeep Puri

India could be $5 trillion economy by 2025, says Union Petroleum Minister Hardeep Puri Economy expected to sustain strong growth amid global gloom

Economy expected to sustain strong growth amid global gloom Indian equities can deliver double digit returns in 2-3 years: Pranav Haridasan, MD & CEO, Axis Securities

Indian equities can deliver double digit returns in 2-3 years: Pranav Haridasan, MD & CEO, Axis Securities India to be one of world's fastest growing economies over next decade

India to be one of world's fastest growing economies over next decade India has high debt like China, but risks are moderated: IMF

India has high debt like China, but risks are moderated: IMF