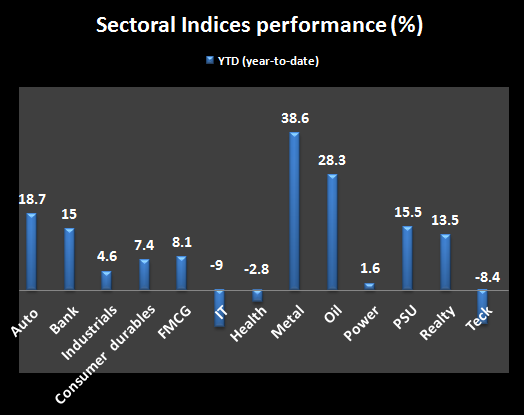

Metals, oil and gas give most returns this year so far

Metal stocks have grown by 39% since January and 63% from the February 2016 lows. Oil and gas stocks have risen by 28%, followed by auto with a growth of 19% and banking with 15% increase.

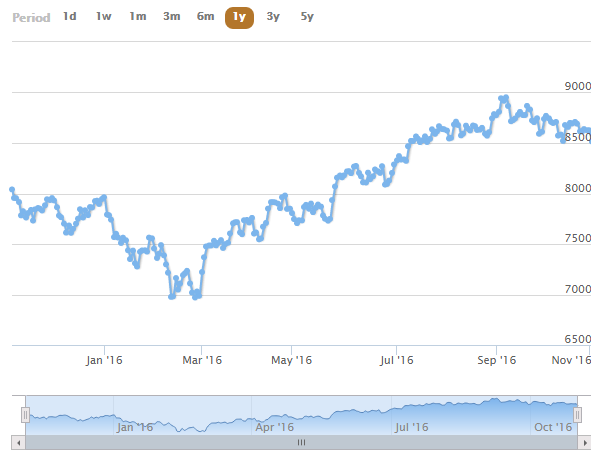

Indian markets may have fallen from its highest point this year but BSE Sensex it still far above its February 2016 low of around 23,000 points.

Sensex on Thursday closed at 27,430.28 points, down 97 points or 0.35%, while Nifty 50 stood at 8,484.95 points, down 29.05 points or 0.35%.

TRENDING NOW

Sectoral Indices :

Metal, oil and gas, automobile and banking sectors are the most preferred stocks so far this year.

Metal stocks have grown by 39% since January and 63% from the February 2016 lows. Oil and gas stocks have risen by 28%, followed by auto with a growth of 19% and banking with 15% increase.

Following their weak Q1 and Q2, IT sector has declined by 9% so far.

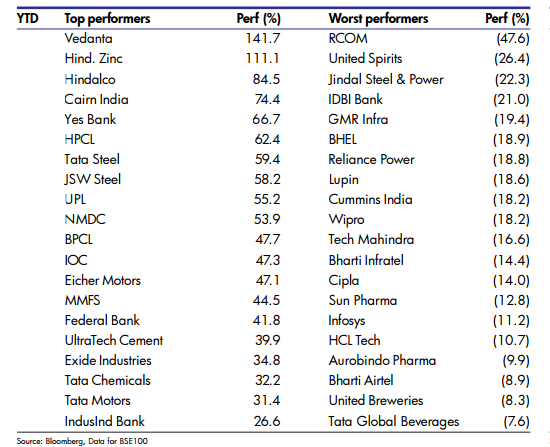

Vedanta and Hindustan Zinc more than doubled while Yes Bank and IndusInd Bank were the gainers in the banking sector.

In auto index, Eicher Motors was the most picked stock by investors which grew by 47.1%. Tata Motors too rose 31.4% year to date.

Among major IT players, Wipro tumbled 18.2%, followed by Tech Mahindra (17%), Infosys (11.2%) and HCL Technologies (10.7%).

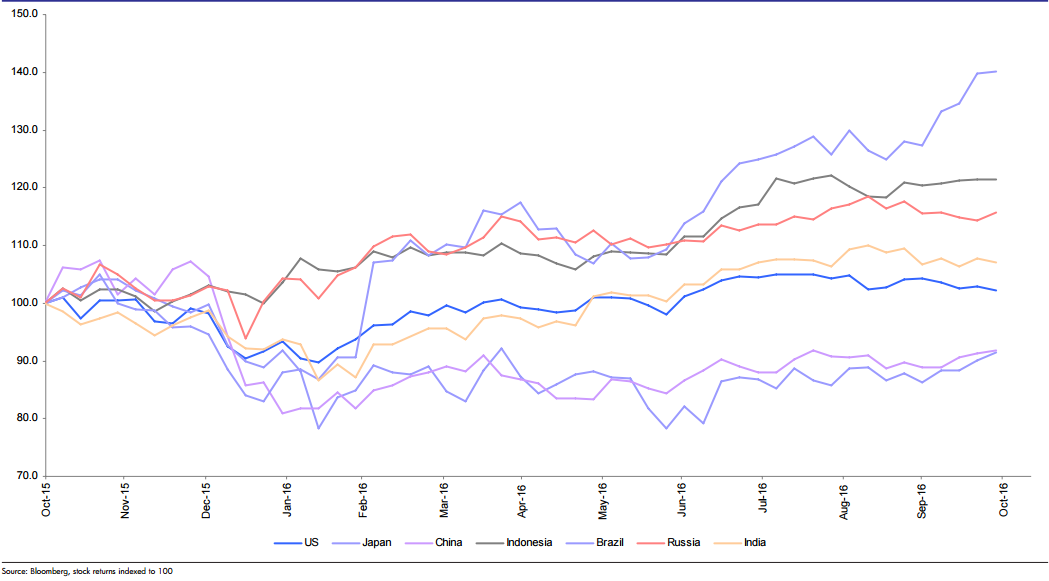

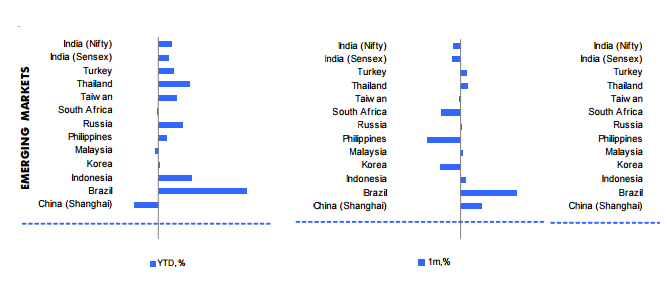

Even after erasing some gains, Indian equity indices are among the global out-performers.

As per the chart above, Indian markets trail only Russia, Indonesia and Brazil - who is the best performer.

Despite of recording negative trend in the month of October 2016, Indian markets have outperformed in comparison with emerging markets, baring Brazil.

Dhirendra Tiwar, Dipojjal Saha analyst at Antique Limited said,"Overall from a market perspective, India is an outperformer over the last 6 months."

They added,"There are multiple events leading upto the year end and as history also suggests November is generally a choppy month for equities."

"YTD, factors are pointing to a value rally with low P/E, high RoE and high earnings growth stocks generally outperforming. To re-iterate global factors will play a role but what will be the main concern from a domestic perspective is how earnings trajectory shapes up."

04:44 pm

Homegrown BPM services provider approves conversion of warrants into equity shares - Details

Homegrown BPM services provider approves conversion of warrants into equity shares - Details Hero MotoCorp, Jet Airways, HUL, Berger Paints: Stocks to watch out for on Thursday

Hero MotoCorp, Jet Airways, HUL, Berger Paints: Stocks to watch out for on Thursday What is loan against shares and how to leverage it for financial growth and flexibility

What is loan against shares and how to leverage it for financial growth and flexibility  PRIMEX 40 Index – A Game-Changing Initiative & India’s First Live Private Market Index

PRIMEX 40 Index – A Game-Changing Initiative & India’s First Live Private Market Index Stock Market: Where to invest when the share market is high?

Stock Market: Where to invest when the share market is high?