Asian stock markets rise as Singapore joins the rate hike pause camp

The Monetary Authority of Singapore (MAS) surprised many by leaving policy unchanged, saying the tightening already underway would ensure inflation slowed sharply later this year.

Asian stock markets were firm on Friday as Singapore became the latest country to pause its policy tightening and markets became more confident the likely next hike in US rates would be the last this cycle.

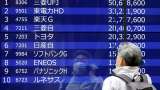

The prospect of a peak for rates helped offset worries about recession and MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) nudged up 0.4 per cent.

Japan's Nikkei (.N225) added 1.1 per cent and Singapore stocks (.STI) 0.5 per cent.

TRENDING NOW

Chinese blue chips (.CSI300) firmed 0.2 per cent, with the economic outlook brightened by a surprisingly upbeat trade performance.

EUROSTOXX 50 futures added 0.3% and FTSE futures 0.2%. S&P 500 futures and Nasdaq futures were steady after sharp gains overnight.

The Monetary Authority of Singapore (MAS) surprised many by leaving policy unchanged, saying the tightening already underway would ensure inflation slowed sharply later this year.

The MAS joined central banks in Canada and Australia in putting hikes on hold, while the U.S. Federal Reserve was seen nearer pausing after a soft producer price report.

The Indian stock markets will remain shut on April 14, 2023, on account of Dr BR Ambedkar (Jayanti) birth anniversary.

The dollar was relatively steady on the yen at 132.57 yen, supported by the Bank of Japan's still uber-easy policy stance.

Oil prices steadied, having slipped overnight after OPEC flagged downside risks to summer oil demand in a monthly report, highlighting rising inventories and challenges to global growth.

Brent edged up 27 cents to $86.36 a barrel, while U.S. crude rose 26 cents to $82.42 per barrel.

The US stock market ended sharply higher on Thursday as Dow Jones, S&P 500, and tech-heavy Nasdaq Composite each rose up to 2 per cent at the close amid better economic data, which showed cooling inflation, fueling optimism about a rate hike pause by US Fed Reserve.

With Reuters Inputs

08:31 am

Asia stocks edge higher as China acts on housing, yuan weakness

Asia stocks edge higher as China acts on housing, yuan weakness Stocks slip, yen surges on speculation of Bank of Japan policy tweak

Stocks slip, yen surges on speculation of Bank of Japan policy tweak US Stock Market News: Dow Jones zooms over 400 points; Nasdaq gains 90 points ahead of tech-heavy earnings week

US Stock Market News: Dow Jones zooms over 400 points; Nasdaq gains 90 points ahead of tech-heavy earnings week Asian stocks track Wall Street gains ahead of U.S. payroll data

Asian stocks track Wall Street gains ahead of U.S. payroll data Asian stocks rally as fears ease over Ukraine, Fed and China

Asian stocks rally as fears ease over Ukraine, Fed and China